Effortless Epoint Payments for Your Store – Fast, Secure, and Global!

Integrate Epoint to accept payments seamlessly—whether it’s credit cards, digital wallets, or more—securely and globally. No boundaries, just endless opportunities!

Epoint Integration

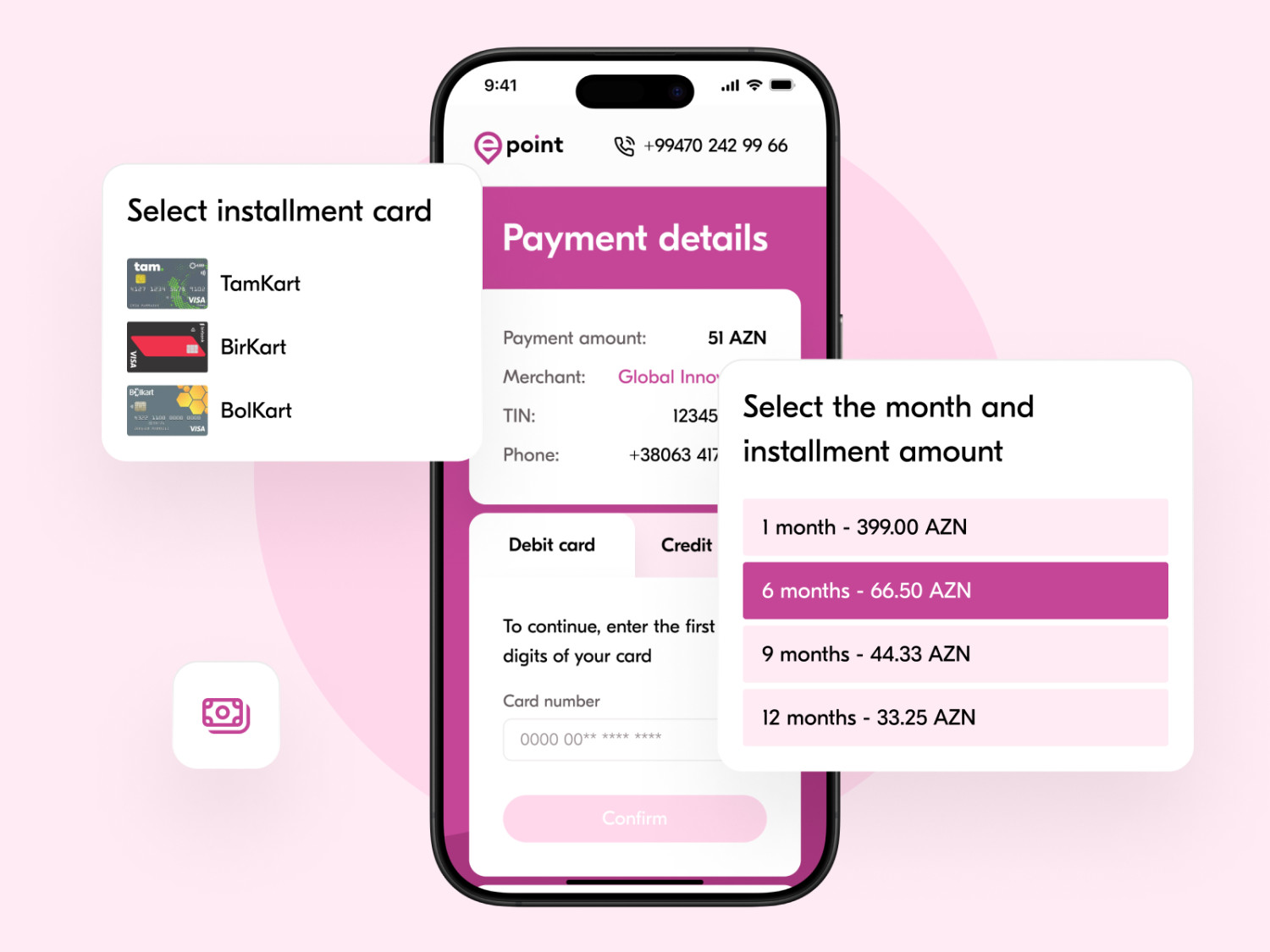

Epoint is a leading payment platform specializing in processing secure online payments for entrepreneurs, like eCommerce store owners. With Epoint, businesses can easily accept payments through a variety of methods, including credit cards, digital wallets, and more—worldwide.

Why Epoint X Store.icu Rocks! 🚀

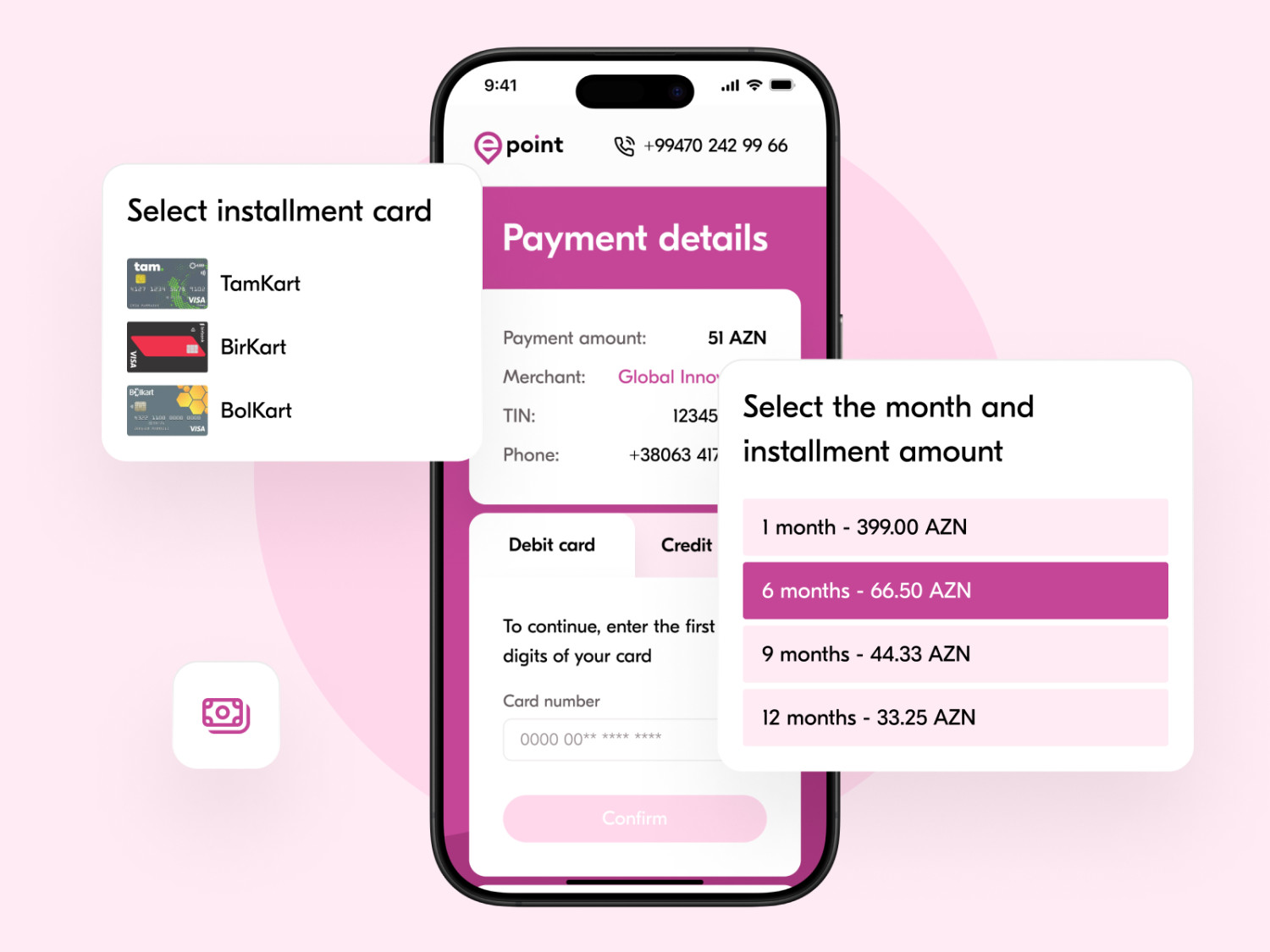

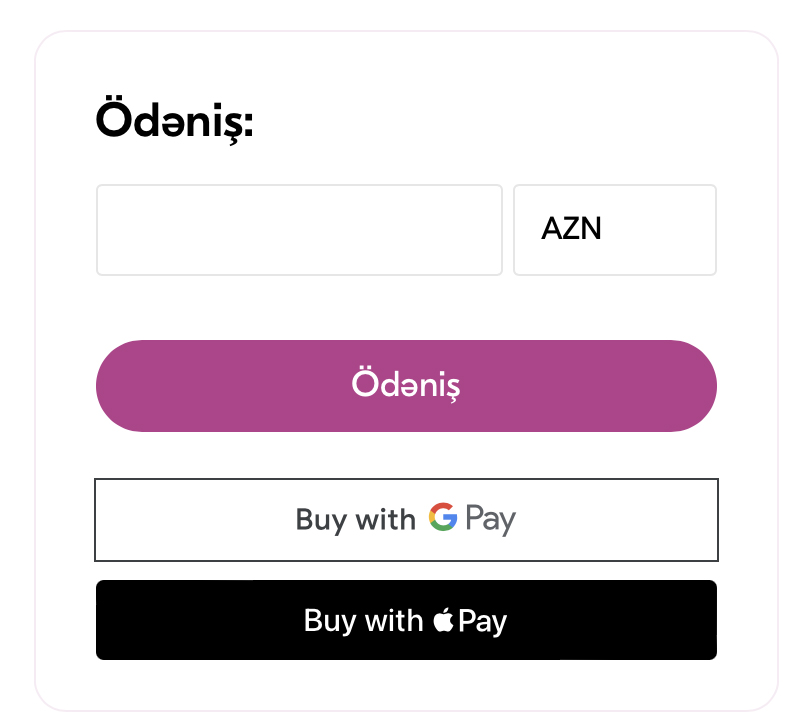

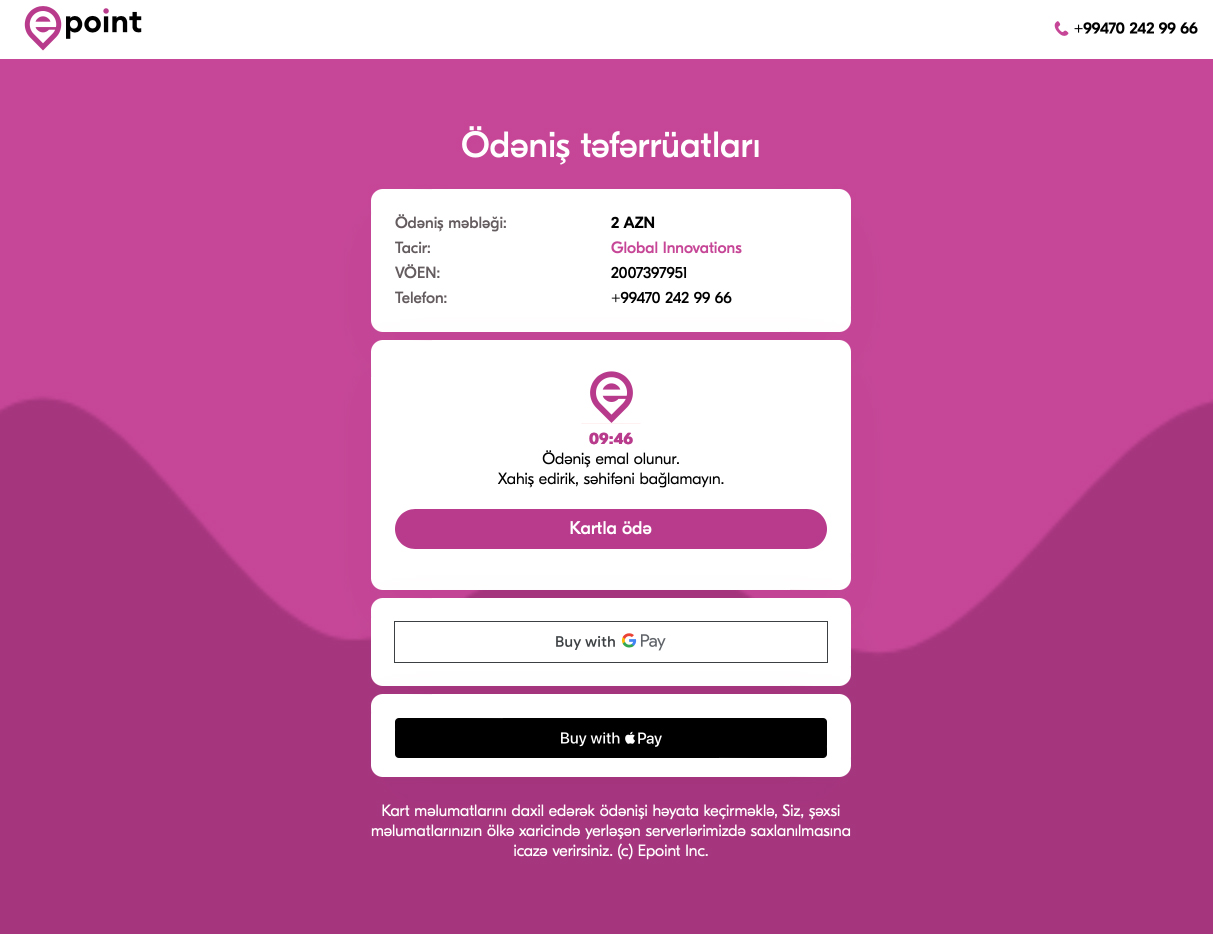

Multiple Payment Options

Accept credit cards, digital wallets, and more to cater to all your customers.

Global Reach

Sell anywhere with confidence, knowing Epoint supports payments worldwide.

Fast & Secure Transactions

Enjoy peace of mind with top-tier security and instant payment processing.

Hassle-Free Integration

Get set up in minutes and start accepting payments with zero headaches.

Epoint: Simple, Reliable, and Global Payments

Epoint supports a wide range of payment options, offering businesses a secure and effortless way to process transactions. Just a heads-up: not all payment methods are available in every country where Epoint operates. Transaction fees may vary depending on the payment method selected and the location of your business.

“At Store.icu, we are committed to providing our merchants and partners with the best payment solutions to fuel their growth. Partnering with Epoint is a game-changer, especially for small and medium-sized businesses looking to scale their online presence. With Epoint’s seamless payment processing, diverse payment options, and secure transactions, our merchants can focus on what they do best—selling. By simplifying digital payments, Epoint empowers entrepreneurs to reach more customers, expand their businesses, and succeed in the ever-growing world of eCommerce.

Michiel Grotenhuis

CEO @ Store.icu

Got Questions? We've Got Answers!

-

How to Set Up the Epoint Payment Gateway?

Before enabling Epoint for your Store.icu store, make sure your Epoint account is fully set up and you’ve selected your preferred payment methods (e.g., credit cards, digital wallets, etc.) in the Epoint dashboard.

- Log in to your Store admin panel.

- Navigate to Settings → Payments in your admin panel.

- Click on the link that says "Add Payment Method."

- If available in your store’s currency, select "Epoint" as your payment provider (if not, follow the necessary steps).

- In the Enable Payment Method section, toggle the switch to activate it.

- Then, enter the "API Key" and "Secret Key" from your Epoint account and click Submit.

-

<b>What Are the Supported Currencies on Epoint?

Epoint primarily supports the following currencies:

- AZN (Azerbaijani Manat)

- USD (US Dollar)

- EUR (Euro)

- and potentially others, depending on the merchant's location and the payment method selected. -

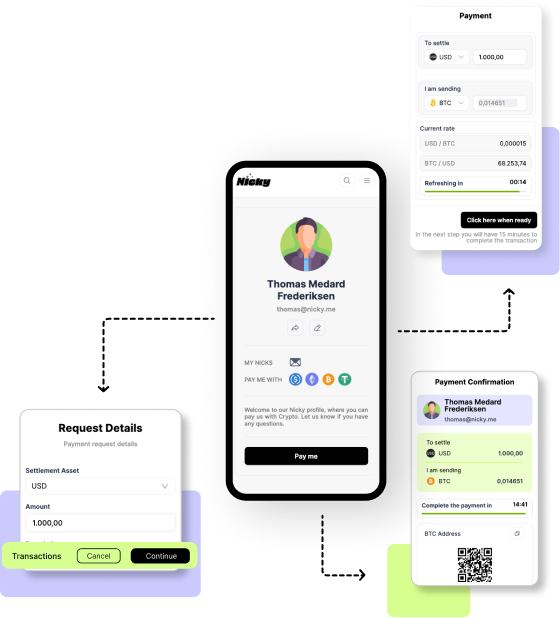

Why is Nicky Not Available with the Currency of My Store?

If Nicky payment is not available due to the cryptocurrency of your account, you won't be able to select this payment option. In this case, you need to change the cryptocurrency of your account.

How to Change the Cryptocurrency of Your Account:

- Go to Settings → General in your Nicky dashboard.

- Click on the Standards and Formats settings.

- Select the cryptocurrency that is supported by Nicky from the Cryptocurrency dropdown menu.

Trending Epoint Posts

Step-by-Step Guide: Setting Up Nicky for

- •

- 13 July 2024

Nicky x Store.icu: A Perfect Match

- •

- 13 July 2024

Ready to Offer Online Stores with ePoint Integration?

Are you a white-label reseller looking to offer your clients stores with Epoint integrated? You’re in the right place! 🎉 With Epoint, your merchants can enjoy seamless and secure payment processing, making online transactions effortless.

Our team is here to support you every step of the way—reach out, and let’s get you set up for success! 🚀

Or drop us a message via email.